Customized Portfolio Construction for Family Offices & QEP Investors

Advanced Alpha Advisers provides independent, institutional-grade portfolio construction and investment consulting services for family offices and Qualified Eligible Participants (QEPs) allocating to managed futures and systematic strategies.

Our work is designed for investors seeking disciplined diversification, capital preservation, and transparent risk management within a total-portfolio framework.

Investment Philosophy

Managed futures serve a specific and differentiated role in institutional portfolios.

They are most effective when intentionally sized, risk-budgeted, and integrated with broader portfolio objectives.

We focus on:

-

Portfolio-level risk outcomes

-

Diversification across market regimes

-

Repeatable, rules-based investment processes

Managed futures are evaluated as risk tools, not standalone return products.

Portfolio Construction Process

1. Investor Mandate & Constraints

We begin by defining:

-

Investment objectives and risk tolerance

-

Drawdown sensitivity and liquidity needs

-

Capital structure and governance requirements

-

Suitability considerations applicable to QEP investors

This establishes a clear framework for portfolio design and oversight.

2. Defining the Role of Managed Futures

We determine how managed futures are intended to function within the portfolio, including:

-

Diversification during equity stress periods

-

Volatility and drawdown mitigation

-

Return stream diversification

-

Adaptive exposure across market regimes

Each allocation has a clearly defined purpose.

3. Strategy & Manager Evaluation

We evaluate managed futures strategies based on:

-

Systematic vs discretionary design

-

Time-horizon and signal diversification

-

Risk targeting, leverage discipline, and drawdown controls

-

Transparency of models, execution, and operational structure

Selection emphasizes interaction effects at the portfolio level.

4. Risk Budgeting & Capital Allocation

Allocations are determined using risk-first principles:

-

Volatility and drawdown contribution

-

Correlation and regime sensitivity analysis

-

Historical stress testing

-

Capital efficiency and margin utilization

Capital is allocated based on risk contribution, not nominal exposure.

5. Implementation Support

We assist with:

-

Fund versus managed account structures

-

Liquidity and redemption alignment

-

Operational and service-provider considerations

-

Phased deployment where appropriate

Implementation is structured to integrate cleanly within family office operations.

6. Ongoing Monitoring & Rebalancing

Post-implementation oversight includes:

-

Ongoing risk and performance monitoring

-

Strategy drift and leverage review

-

Rebalancing frameworks tied to predefined thresholds

-

Periodic portfolio reviews aligned with governance cycles

7. Reporting & Oversight

Clients receive institutionally aligned reporting, including:

-

Portfolio-level risk and correlation analysis

-

Strategy-level performance attribution

-

Drawdown and stress scenario summaries

-

Investment committee–ready reporting

Managed Futures in Family Office Portfolios

For family offices and QEP investors, managed futures offer:

-

Liquid, exchange-traded market exposure

-

Ability to take long and short positions

-

Dynamic risk management

-

Historically low correlation to traditional assets

Their effectiveness depends on proper sizing, diversification, and ongoing oversight.

Illustrative Case Studies (Anonymous)

Family Office Diversification Mandate

Introduced a diversified managed futures allocation to reduce equity drawdown exposure while maintaining return potential. Resulted in improved portfolio resilience and clearer role definition.

QEP Investor – Systematic Transition

Replaced discretionary trading exposure with systematic strategies featuring transparent risk controls, improving consistency and governance.

Multi-Strategy Portfolio Optimization

Re-sized managed futures exposure using risk contribution analysis, reducing unintended concentration and stabilizing overall portfolio volatility.

What We Do / What We Do Not Do

What We Do

-

Provide independent portfolio construction and consulting

-

Focus on managed futures within total portfolios

-

Emphasize risk budgeting and diversification

-

Support institutional governance and reporting

What We Do Not Do

-

Guarantee performance or outcomes

-

Promote products without portfolio context

-

Rely on return-only selection criteria

-

Replace custodians, administrators, or legal advisors

Who We Work With

-

Single and multi-family offices

-

Qualified Eligible Participants (QEPs)

-

Sophisticated private investors and allocators

Next Steps

We offer an introductory consultation to review:

-

Existing portfolio structure

-

Current managed futures exposure

-

Risk alignment and potential optimization opportunities

-

Contact us to begin a structured portfolio review.

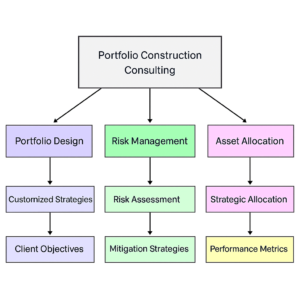

Key Service Components

-

Portfolio Design: Crafting tailored investment strategies aligned with client goals, risk tolerance, and market conditions.

-

Risk Management: Assessing and mitigating risks through advanced analytics and hedging strategies.

-

Asset Allocation: Strategic and tactical allocation across asset classes (equities, fixed income, alternatives) for diversification.

-

Performance Analysis: Evaluating portfolio performance with key metrics and optimization techniques to enhance returns.